Artificial intelligence in banking refers to computer systems that learn from data to automate financial tasks, detect fraud, and improve customer service without constant human programming.

The banking industry has experienced a dramatic transformation in AI adoption. Industry research shows systematic AI implementation rose from 8 percent of banking institutions in 2024 to 78 percent by early 2025. This rapid change reflects both technological advancement and competitive necessity.

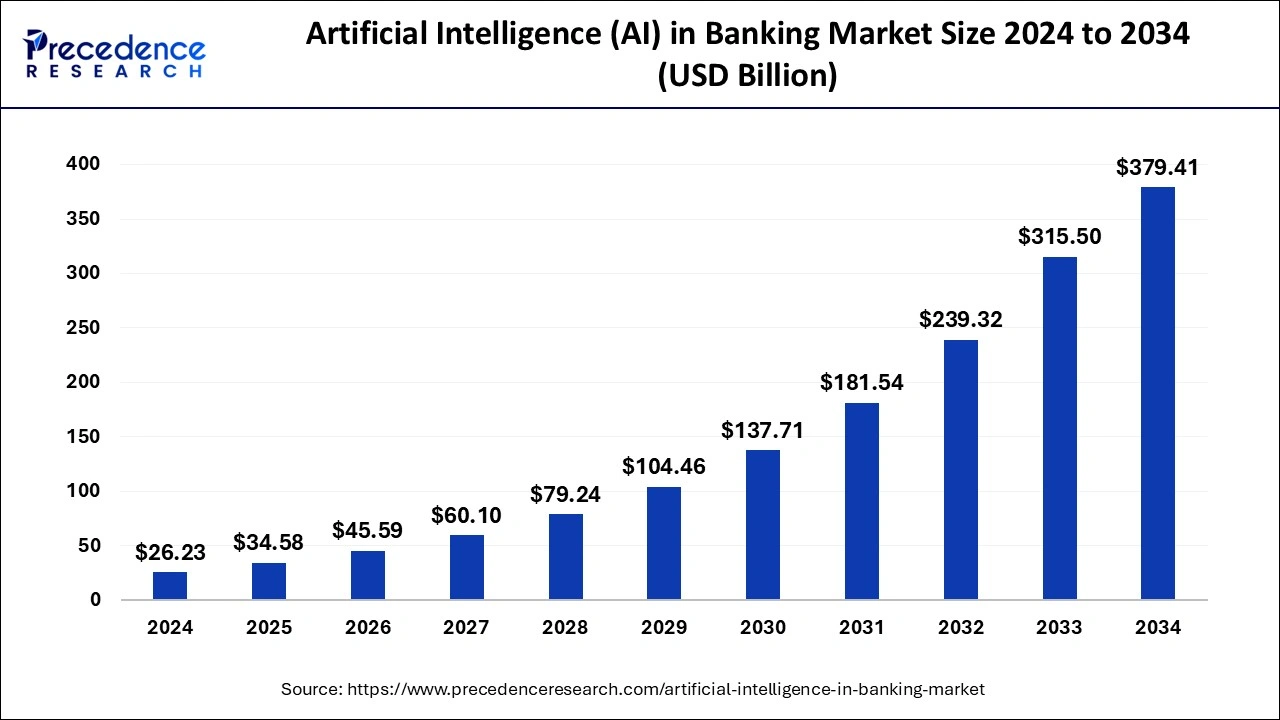

Source: Precedence Research

Financial institutions now use AI for everything from processing loan applications to preventing cyber attacks. Machine learning algorithms analyze millions of transactions in real time to spot suspicious activity. Natural language processing powers chatbots that handle customer questions 24/7.

Banks that implement AI report significant improvements in efficiency and customer satisfaction. The technology has moved beyond experimental phases to become essential for modern banking operations. Regulatory frameworks have evolved to support responsible AI development while protecting consumers.

What Is AI in Banking

AI in banking means using computer systems that can learn and make decisions like humans, but much faster and more consistently. Unlike traditional banking software that follows predetermined rules, AI systems analyze patterns in data and adapt their responses based on new information.

Traditional banking technology operates through fixed programming where specific inputs produce predictable outputs. For example, a conventional system might check if an account balance exceeds a withdrawal amount and either approve or deny the transaction. AI systems examine multiple variables simultaneously, recognize complex patterns, and make nuanced decisions that improve over time.

Machine Learning Applications

Machine learning enables computers to identify patterns in large datasets without explicit programming for each scenario. Banks use these algorithms to assess credit risk by analyzing thousands of variables including payment history, spending patterns, income stability, and economic indicators.

Fraud detection represents another significant machine learning application. These systems monitor transaction patterns for each customer, learning normal spending behaviors and flagging unusual activities. When a customer typically shops locally but suddenly makes multiple international purchases, the system recognizes this deviation and can temporarily freeze the account pending verification.

Natural Language Processing in Banking

Natural language processing allows computers to understand and respond to human speech and text. Banks deploy chatbots powered by this technology to handle customer inquiries, process simple transactions, and provide account information.

Voice banking systems use natural language processing to enable customers to check balances, transfer funds, or pay bills through spoken commands. The technology converts speech to text, interprets the customer’s intent, and executes the requested action while maintaining security protocols through voice recognition.

How AI Transforms Banking Operations

Banks use artificial intelligence to automate complex processes that once required manual work from thousands of employees. These AI systems handle everything from processing payments to detecting fraud, making banking operations faster and more accurate than ever before.

The transformation goes beyond simple automation. AI systems learn from patterns in data to make decisions, predict problems, and adapt to new situations without human programming for each scenario.

Automated Transaction Processing

AI-powered systems now handle the majority of routine banking transactions without human involvement. These systems process millions of payments, transfers, and deposits every day while maintaining accuracy rates above 99.5 percent.

Modern transaction processing systems can complete standard transfers in under 15 seconds compared to the previous 3-5 minute processing times. The speed improvements come from AI algorithms that instantly verify account details, check balances, and confirm regulatory compliance requirements simultaneously.

Intelligent Document Analysis

Machine learning systems extract and analyze information from banking documents with accuracy rates that often exceed human performance. These systems use optical character recognition combined with natural language processing to understand context and meaning in financial documents.

AI document analysis systems can process loan applications 75 percent faster than manual review while maintaining accuracy rates above 95 percent. The technology reads handwritten forms, typed documents, and even poor-quality scans to extract relevant information automatically.

Real-Time Risk Assessment

AI algorithms analyze every transaction as it occurs, comparing patterns against millions of historical transactions to identify potential fraud or suspicious activity. These systems process risk assessments in milliseconds while customers complete their banking activities.

Real-time risk assessment examines over 200 variables for each transaction, including location data, device information, transaction amounts, timing patterns, and behavioral characteristics. The systems learn normal patterns for each customer and flag deviations that might indicate fraudulent activity.

AI Fraud Detection and Security

Artificial intelligence has transformed how banks protect customers from financial crimes and cyber threats. Leading financial institutions report fraud detection rates exceeding 99 percent while maintaining false positive rates below 1 percent.

Banks using AI-powered fraud detection prevent billions in losses annually while processing millions of transactions in real-time. The financial impact extends beyond direct loss prevention, with banks reporting 30-40 percent reductions in investigation costs and improved customer trust scores.

Machine Learning Threat Detection

Machine learning algorithms process millions of transactions simultaneously to identify patterns that indicate fraudulent activity. Banks use supervised learning systems that train on historical fraud data to recognize known patterns.

Source: ResearchGate

When a customer’s debit card gets used at an ATM in a foreign country while their phone location shows they remain at home, the system flags this geographic impossibility as suspicious. Unsupervised learning detects previously unknown fraud patterns without requiring prior examples, helping identify new criminal techniques.

Behavioral Analysis Systems

AI systems create detailed profiles of individual customer behavior patterns to detect unauthorized account access and fraudulent transactions. These systems learn how customers typically interact with their accounts, including preferred transaction times, common merchants, average purchase amounts, and device usage patterns.

Customer behavior profiles include transaction frequency patterns, geographic spending habits, and device interaction preferences. When someone accesses an account using different typing patterns, mouse movements, or navigation habits than the legitimate account holder, the system detects these behavioral anomalies.

Advanced Authentication Methods

AI enhances biometric authentication systems through voice recognition, facial recognition, and behavioral biometrics. Voice recognition systems analyze speech patterns, including vocal frequency, pronunciation habits, and speaking rhythm to verify customer identity.

Banks implement voice biometrics for phone banking services, achieving 95 percent accuracy rates while reducing average call verification time from 90 seconds to 15 seconds. Facial recognition technology verifies customer identity through mobile banking applications and ATM transactions with 99 percent accuracy rates.

AI Customer Experience Enhancement

Financial institutions use artificial intelligence to create personalized banking experiences that adapt to individual customer needs and preferences. AI systems analyze customer data including transaction histories, communication patterns, and financial behaviors to deliver customized service across all interaction channels.

Banks implementing comprehensive AI customer experience strategies report 15-20 percent increases in customer satisfaction scores and improved retention rates. AI transforms customer interactions from reactive problem-solving to proactive assistance and guidance.

Intelligent Chatbots and Virtual Assistants

AI-powered chatbots handle routine customer inquiries, account questions, and basic transactions using natural language processing to understand conversational requests. Advanced systems process complex questions about account balances, transaction histories, payment scheduling, and product information.

Natural language understanding enables chatbots to interpret customer intent from conversational text or voice inputs. Modern banking chatbots can handle requests like “Show me my spending on restaurants last month” or “Help me set up automatic savings transfers” by parsing the customer’s language and accessing relevant account information.

Leading banks report chatbot resolution rates between 80-85 percent for routine inquiries, with customer satisfaction scores for AI interactions reaching 4.2 out of 5 on average. Response times average under 10 seconds compared to several minutes for human agents during peak periods.

Source: Intelekt AI

Personalized Financial Recommendations

AI systems analyze spending patterns, account balances, and financial goals to generate customized product recommendations and financial guidance. Machine learning algorithms process transaction data to identify spending categories, seasonal patterns, and financial behaviors.

Investment recommendation engines evaluate customer risk tolerance, financial objectives, and market conditions to suggest portfolio adjustments and investment opportunities. AI systems can recommend specific mutual funds, retirement account contributions, or rebalancing strategies based on individual circumstances.

Banks report 25-30 percent higher engagement rates for AI-generated investment recommendations compared to generic marketing offers. Conversion rates for AI-recommended financial products average 8-12 percent compared to 3-5 percent for traditional marketing campaigns.

Proactive Customer Support

AI systems identify potential customer needs and initiate helpful communications before customers request assistance. Predictive analytics analyze account activity, transaction patterns, and external factors to anticipate situations where customers might benefit from proactive outreach.

Account alert systems use AI to generate intelligent notifications about unusual transactions, low balances, upcoming payments, or potential fraud attempts. These systems balance security requirements with user experience by adjusting alert sensitivity based on individual customer preferences.

Financial wellness notifications provide proactive guidance about savings opportunities, bill payment reminders, and credit score impacts. Banks implementing proactive support report 25 percent fewer customer complaints and improved relationship satisfaction scores.

AI in Lending and Credit Assessment

Artificial intelligence has transformed how banks evaluate loan applications and assess credit risk. Modern lending systems use machine learning algorithms to analyze borrower data, predict default probability, and make faster credit decisions while maintaining regulatory compliance.

AI systems in lending analyze patterns across millions of loan records to identify factors that predict successful repayment. Machine learning models incorporate traditional credit bureau data alongside alternative information sources to create comprehensive borrower profiles.

Automated Underwriting Systems

AI-powered underwriting systems evaluate loan applications by analyzing multiple data sources simultaneously. Traditional manual underwriting typically requires 5-10 business days for mortgage applications and 2-3 days for personal loans. Automated systems reduce these timeframes to 30 minutes for personal loans and 24-48 hours for mortgages.

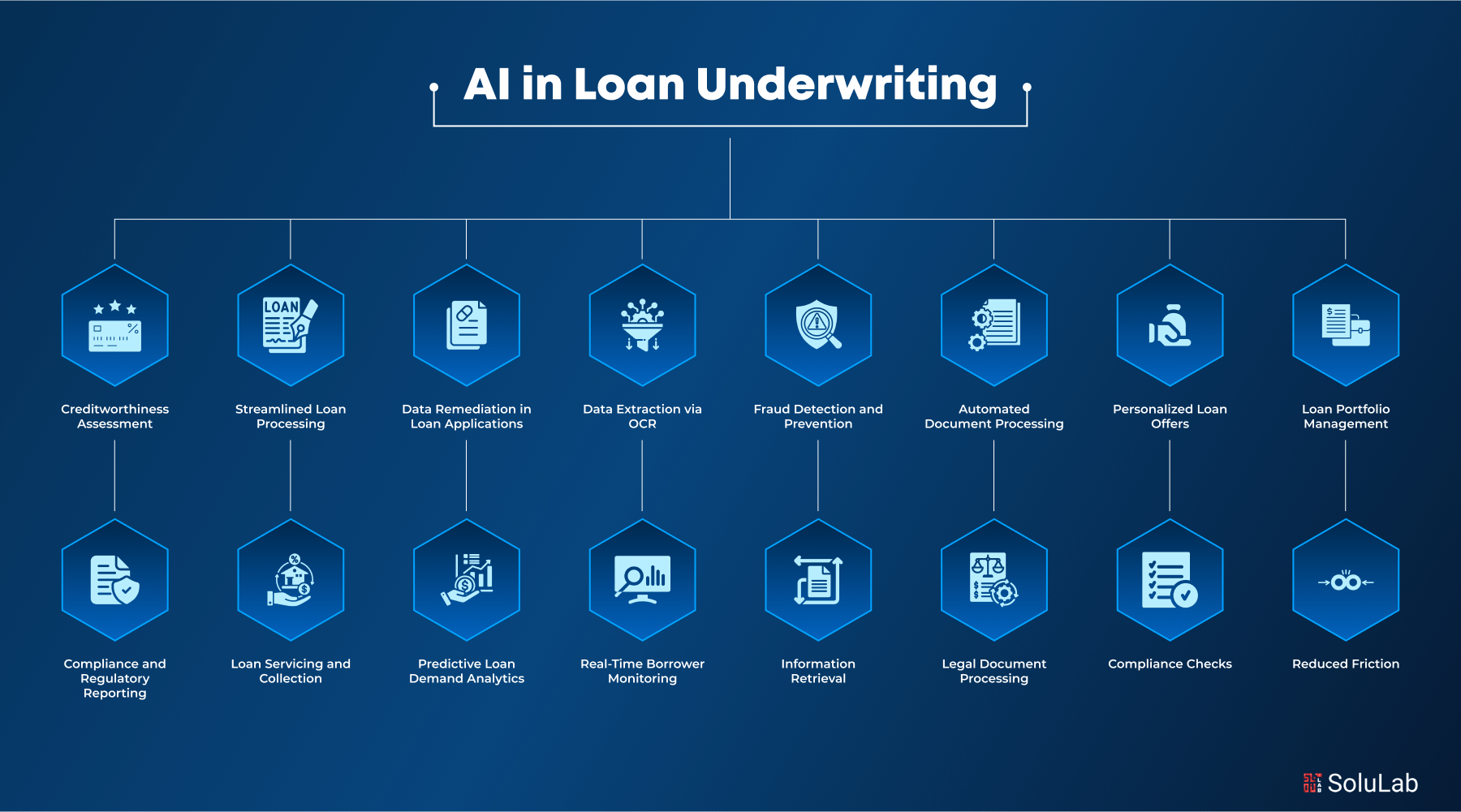

Source: SoluLab

Machine learning algorithms process credit scores, income verification, debt-to-income ratios, employment history, and asset documentation in parallel rather than sequentially. Banks report 60-80 percent faster processing times compared to manual reviews while maintaining equivalent or improved decision accuracy.

Automated systems eliminate human error in data entry and calculation while ensuring consistent application of lending criteria. Machine learning models identify patterns in successful loans that human underwriters might overlook, leading to more accurate risk assessment.

Alternative Data Credit Scoring

AI incorporates non-traditional data sources to evaluate creditworthiness for borrowers with limited credit history. Alternative data includes utility payments, rent payments, bank account transaction patterns, mobile phone payment history, and education credentials.

Banks use alternative data to serve thin-file borrowers who lack sufficient credit bureau history. Alternative data credit models can score 28 million additional consumers who were previously unscorable using traditional methods.

Regulatory compliance requires careful implementation of alternative data models to avoid discriminatory outcomes. Banks validate that alternative data sources do not create disparate impact on protected classes defined by fair lending laws.

Risk Prediction Models

Machine learning models predict loan default probability with greater accuracy than traditional statistical methods. Advanced algorithms analyze hundreds of variables to identify subtle patterns that indicate repayment risk.

Banks report 15-25 percent improvement in default prediction accuracy using ensemble machine learning models compared to conventional logistic regression approaches. Portfolio risk management systems use predictive models to monitor loan performance across customer segments and economic conditions.

Stress testing capabilities allow banks to model portfolio performance under various economic scenarios. AI systems simulate how different interest rate environments, unemployment levels, and market conditions affect default rates across loan types.

Benefits of Banking AI Implementation

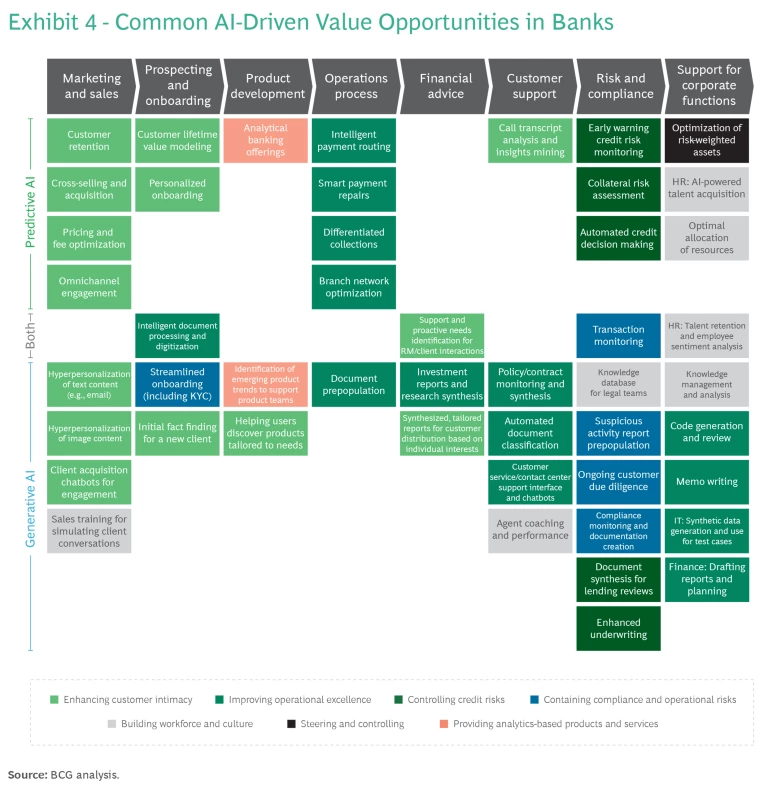

Banking institutions implementing artificial intelligence technologies achieve measurable improvements across multiple operational dimensions. McKinsey Global Institute estimates generative AI could contribute $200-340 billion in value to the banking sector through operational enhancements and service improvements.

Operational Efficiency Improvements

AI reduces manual processing requirements and accelerates transaction completion across banking operations. Leading institutions report significant cost reductions and productivity gains from automated systems:

- Processing time reductions — Complex transactions complete 50-75 percent faster with AI automation

- Cost-per-transaction improvements — Banks achieve 30-40 percent lower operational costs for automated processes

- Document processing efficiency — Intelligent document systems handle loan applications with minimal human intervention

- Credit underwriting acceleration — Automated systems reduce loan processing from weeks to days or hours

- Compliance automation — Anti-money laundering and regulatory reporting complete with reduced manual oversight

Source: Business Insider

Enhanced Security and Risk Management

AI provides advanced threat detection capabilities that exceed traditional security measures in both speed and accuracy. Financial institutions implementing comprehensive AI security systems demonstrate substantial risk reduction.

Leading banks achieve 99 percent fraud identification accuracy with false positive rates below 1 percent. Real-time risk assessment systems evaluate transaction risk in milliseconds using hundreds of variables simultaneously.

Behavioral biometrics provide continuous authentication through typing patterns and device interactions to prevent unauthorized access. Network analysis algorithms identify organized fraud rings and money laundering operations across complex relationship networks.

Superior Customer Experience

AI enables personalized banking services that adapt to individual customer needs and preferences. Banks implementing comprehensive AI customer experience strategies report substantial satisfaction improvements.

Virtual assistants handle complex inquiries outside traditional banking hours with human-like interaction quality. Personalized recommendations analyze transaction histories and behavioral patterns to provide targeted financial guidance and product suggestions.

Automated systems process routine requests immediately without human intervention requirements. Banks report double-digit improvements in satisfaction metrics following AI implementation, with institutions achieving 15-20 percent increases in loyalty scores.

AI Implementation Challenges and Solutions

Banks face significant obstacles when implementing artificial intelligence technology. These challenges span technical, regulatory, organizational, and infrastructure domains. Understanding common barriers and proven solutions helps financial institutions navigate AI adoption more effectively.

Data Quality and Integration Issues

Poor data quality represents the most fundamental barrier to effective AI implementation in banking. AI systems require clean, standardized, and accessible data to function properly. Legacy banking systems often store information in incompatible formats across multiple databases.

Data cleansing involves identifying and correcting errors, removing duplicates, and standardizing formats across different systems. Banks typically discover that 20-30 percent of their data contains errors or inconsistencies that limit AI effectiveness.

Integration across legacy systems presents technical challenges because older banking infrastructure was not designed for modern data sharing. Many banks operate core systems that are decades old, requiring significant technical work to extract and transform data for AI applications.

Regulatory Compliance Requirements

AI implementation in banking operates within strict regulatory frameworks designed to protect consumers and maintain financial system stability. Compliance requirements vary by jurisdiction but generally emphasize transparency, fairness, and accountability in automated decision-making processes.

Source: LeewayHertz

Model governance encompasses the policies, procedures, and controls that banks use to manage AI systems throughout their lifecycle. Regulatory agencies expect banks to validate AI models before deployment, monitor performance continuously, and maintain detailed documentation.

Explainability requirements mandate that banks can explain how AI systems reach specific decisions, particularly for credit underwriting and risk assessment applications. The Federal Reserve and other regulators emphasize that banks cannot treat AI systems as “black boxes.”

Change Management Strategies

Employee resistance represents a significant barrier to AI adoption in banking organizations. Workers often fear job displacement or struggle to adapt to new technology-driven processes. Successful change management addresses both emotional and practical concerns.

Training programs help employees develop skills needed to work effectively with AI systems. Banks typically implement multi-tier training approaches that provide basic AI literacy for all staff while offering specialized technical training for employees who will work directly with AI applications.

Executive sponsors champion AI initiatives and communicate the strategic importance of technology adoption throughout the organization. Leadership commitment helps overcome resistance by demonstrating that AI implementation aligns with organizational priorities and career development opportunities.

Technology Infrastructure Needs

Legacy banking systems often lack the computational resources and architectural flexibility needed to support AI applications effectively. Most banks operate core systems that were designed decades ago for transaction processing rather than advanced analytics.

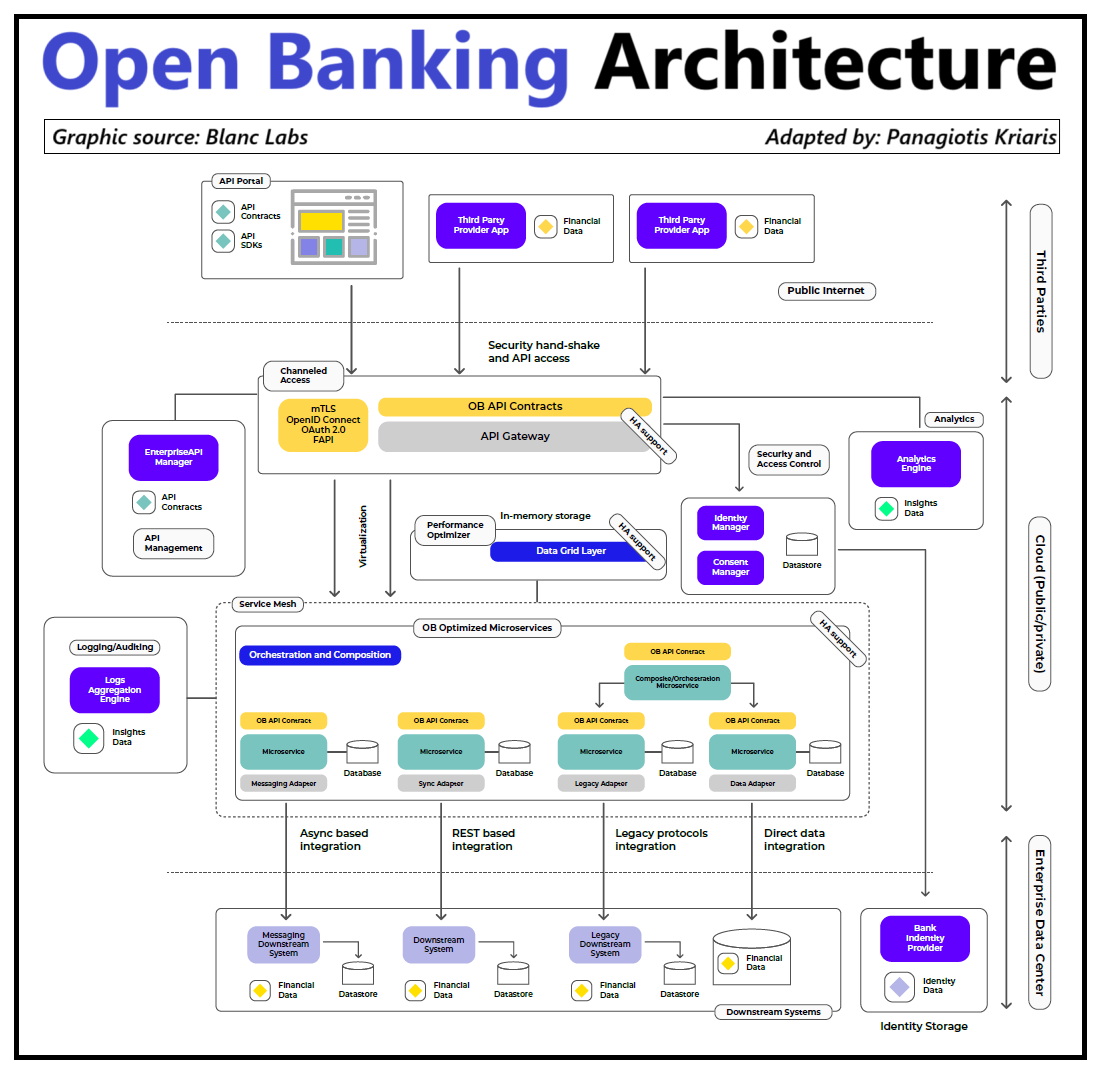

Source: Panagiotis’ FinTech Newsletter

Cloud migration provides the scalable computing resources and advanced AI services needed for sophisticated applications. Banks can access machine learning platforms, data storage, and processing capabilities without massive on-premises infrastructure investments.

API development creates interfaces that allow AI systems to access data and functionality from existing banking applications. APIs enable integration between legacy systems and modern AI platforms without requiring complete system replacement.

Building Your Banking AI Strategy

Financial institutions have moved from experimental AI pilots to systematic enterprise-wide deployment. Banks planning AI implementation face complex decisions around technology selection, resource allocation, and risk management that require structured approaches.

Current State Assessment

Technology infrastructure evaluation forms the foundation of any AI strategy. Banks begin by cataloging existing systems, data storage capabilities, and computing resources to understand what technology gaps exist.

Legacy core banking systems often require significant upgrades or integration work to support modern AI applications. Cloud computing infrastructure has proven essential for supporting AI at scale, as these systems require substantial computational resources for training and deploying machine learning models.

Data quality assessment reveals critical information about an institution’s readiness for AI implementation. AI systems depend entirely on data quality and availability for their effectiveness. Banks conduct comprehensive audits of their data sources, examining accuracy, completeness, consistency, and accessibility.

Use Case Prioritization

High-impact, low-risk applications provide optimal starting points for AI implementation in banking environments. Document processing represents one area where AI delivers immediate value with manageable risk exposure.

Customer service automation through chatbots and virtual assistants offers measurable benefits with controlled risk profiles. These systems handle routine inquiries, account information requests, and transaction support while maintaining security protocols and regulatory compliance.

Business value criteria guide use case selection through quantitative and qualitative assessment measures. Banks calculate potential cost savings, revenue generation opportunities, and operational efficiency improvements for each proposed AI application.

Technology Partner Selection

Building internal capabilities versus external partnerships represents a fundamental strategic decision that affects long-term AI competitiveness and operational flexibility. Internal development provides complete control over technology roadmaps while requiring substantial investment in talent acquisition.

Professional AI consulting firms offer immediate access to specialized expertise and proven implementation methodologies while reducing internal resource requirements. External partnerships accelerate implementation timelines and provide access to industry best practices developed across multiple client engagements.

Evaluation criteria for partner selection include technical capabilities, industry experience, and cultural alignment factors. Banks assess consultant expertise in specific AI technologies relevant to their use cases, such as natural language processing for customer service or machine learning for fraud detection.

Future of AI in Banking Technology

The banking industry stands at the beginning of a transformation that will reshape how financial services operate over the next decade. Current trends indicate that artificial intelligence will evolve from supporting specific tasks to managing entire banking processes autonomously.

Generative AI Evolution

Generative AI systems in banking will advance beyond simple chatbots to comprehensive financial advisors. By 2027, these systems will create personalized investment strategies, generate detailed financial reports, and draft complex loan documents with minimal human oversight.

The technology will enable real-time financial planning services where AI analyzes a customer’s spending patterns, income fluctuations, and life goals to generate customized budgets and investment recommendations. Early implementations show promise in wealth management, where AI creates portfolio strategies tailored to individual risk tolerance.

Autonomous Banking Systems

Banking operations will transition toward autonomous systems that handle routine decisions without human intervention. These systems will approve loans, detect fraud, and manage investment portfolios based on predetermined parameters and continuous learning from market data.

Transaction processing will become fully automated for standard operations like wire transfers, bill payments, and account reconciliations. AI systems will monitor these processes continuously, identifying exceptions and routing complex cases to human specialists only when necessary.

Customer service will evolve into AI-powered platforms that resolve most inquiries without human assistance. These systems will access account information, process transactions, and provide financial guidance through natural conversation interfaces.

Implementation Timeline and Adoption Forecasts

The adoption of advanced AI technologies follows predictable patterns based on complexity and regulatory requirements. Simple automation tasks are already widespread, while more sophisticated applications require additional development and testing.

Source: Boston Consulting Group

Enhanced generative AI for customer service and basic financial planning will expand in 2025-2026, along with increased automation in back-office operations and improved fraud detection through machine learning. Pilot programs for autonomous loan processing will begin during this period.

By 2027-2028, banks will see widespread deployment of AI financial advisors, autonomous processing for standard banking transactions, and advanced risk modeling with early quantum computing integration. Comprehensive AI governance frameworks will become standard practice.

Getting Started with AI Transformation

The journey from traditional banking operations to AI-enabled services represents one of the most significant transformations the financial services industry has ever undertaken. Success requires comprehensive strategic planning, deep expertise in both banking operations and AI capabilities, and careful attention to regulatory requirements.

The complexity of AI transformation in banking cannot be overstated. Financial institutions navigate intricate regulatory frameworks while implementing sophisticated technology solutions that integrate with decades-old legacy systems. The stakes are particularly high in banking, where errors can result in regulatory violations, financial losses, and damaged customer relationships.

Professional expertise becomes essential when considering the unique challenges that banks face in AI implementation. Unlike other industries, financial services operate under strict regulatory oversight that requires AI systems to be transparent, explainable, and auditable.

For banking leaders ready to begin their AI transformation journey, the first step is understanding exactly where your institution stands today and developing a clear roadmap for where you want to be. This assessment requires both technical evaluation of your current systems and strategic analysis of your business objectives and competitive position.

Frequently Asked Questions About Banking AI

How does AI improve fraud detection compared to traditional methods?

AI fraud detection systems analyze hundreds of variables simultaneously to identify suspicious patterns that traditional rule-based systems miss. Machine learning algorithms learn normal behavior patterns for each customer and flag deviations that indicate potential fraud.

Traditional fraud detection relies on predetermined rules that criminals can learn to circumvent. AI systems adapt continuously, recognizing new fraud techniques without requiring manual programming updates. Banks report fraud detection rates exceeding 99 percent with AI compared to 70-80 percent accuracy rates for rule-based systems.

What specific regulatory requirements apply to AI lending decisions?

AI lending systems must comply with the Equal Credit Opportunity Act and Fair Housing Act, which prohibit discrimination based on protected characteristics. Banks must demonstrate that AI models produce fair outcomes across different demographic groups.

The Consumer Financial Protection Bureau requires banks to provide clear explanations for adverse credit actions, including those made by AI systems. Financial institutions must maintain audit trails showing how AI systems reach lending decisions and document ongoing monitoring for bias or discrimination.

How long does it typically take to implement AI chatbots in banking?

Basic AI chatbot implementation for customer service typically requires 3-6 months from planning to launch. This timeline includes system integration, natural language processing training, security implementation, and staff training.

More sophisticated virtual assistants that handle complex transactions and provide financial advice require 8-12 months for full deployment. The timeline depends on integration complexity with existing banking systems and the scope of services the chatbot will provide.

Which AI applications provide the fastest return on investment for banks?

Document processing automation delivers the fastest ROI, typically showing positive returns within 6-12 months. AI systems that extract information from loan applications, compliance documents, and financial statements reduce processing costs by 40-60 percent while improving accuracy.

Fraud detection systems also provide quick returns through direct loss prevention. Banks typically see ROI within 12-18 months as AI systems prevent fraudulent transactions and reduce investigation costs while improving customer experience through fewer false positives.

How do banks ensure AI systems remain compliant with changing regulations?

Banks establish governance frameworks that include regular model validation, performance monitoring, and compliance testing. These frameworks incorporate automated systems that track regulatory changes and assess their impact on existing AI applications.

Financial institutions maintain detailed documentation of AI system decision-making processes and implement continuous monitoring for bias, accuracy, and regulatory compliance. Banks typically designate compliance teams specifically responsible for AI oversight and regulatory alignment.