Artificial intelligence helps banks detect and prevent fraudulent transactions by analyzing patterns in real-time data that would be impossible for humans to spot manually.

Banks face an enormous challenge protecting customer accounts from increasingly sophisticated fraud attempts. Traditional fraud detection methods relied on basic rules that flagged transactions above certain amounts or from unusual locations. These older systems often missed complex fraud schemes while incorrectly blocking legitimate transactions.

Source: Scalefocus

Modern AI systems can analyze millions of transactions per second, examining hundreds of variables simultaneously to identify suspicious patterns. Machine learning algorithms learn from historical fraud data to recognize new threats before they cause damage. Financial institutions using AI-powered fraud detection report up to 40 percent reductions in successful fraud attempts while cutting false alarms by more than half.

The speed of digital banking requires instant fraud decisions. When someone swipes a card or initiates an online transfer, AI systems have milliseconds to determine whether the transaction appears legitimate or suspicious. Real-time analysis protects both banks and customers from financial losses that traditional batch processing systems could not prevent.

Traditional Banking Fraud Detection vs AI-Powered Systems

Banks have used two main approaches to catch fraud over the years. Traditional rule-based systems worked like a security checklist — they flagged transactions that broke predetermined rules. AI-powered systems work more like a detective — they learn patterns and adapt to new fraud techniques as they emerge.

Rule-based fraud detection systems operated on fixed rules that human experts created. When a customer tried to spend $5,000 in a foreign country, the system would automatically flag the transaction because it exceeded a set dollar amount threshold. When someone made three purchases within ten minutes, the system would block the account because rapid transactions violated another rule.

These traditional systems created significant problems. They generated false positives when legitimate customers triggered the rules — like a family vacation purchase or holiday shopping spree. The systems missed sophisticated fraud that stayed below the thresholds. Criminals quickly learned the rules and structured their activities to avoid detection.

Machine learning systems analyze patterns differently. Instead of following rigid rules, these systems study millions of transactions to learn what normal behavior looks like for each customer. When Sarah typically spends $50 at grocery stores on weekdays, the system notices if someone suddenly uses her card for $200 electronics purchases at midnight.

Source: ResearchGate

AI approaches deliver measurable improvements:

- Higher accuracy — Detection rates reach 85-95 percent compared to 60-70 percent for traditional systems

- Fewer false alarms — False positive rates drop to 3-8 percent versus 15-25 percent with rule-based methods

- Faster processing — Decisions happen in milliseconds rather than 10-30 seconds

- Automatic adaptation — Systems learn continuously without manual rule updates

Core AI Technologies Transforming Real-Time Fraud Detection

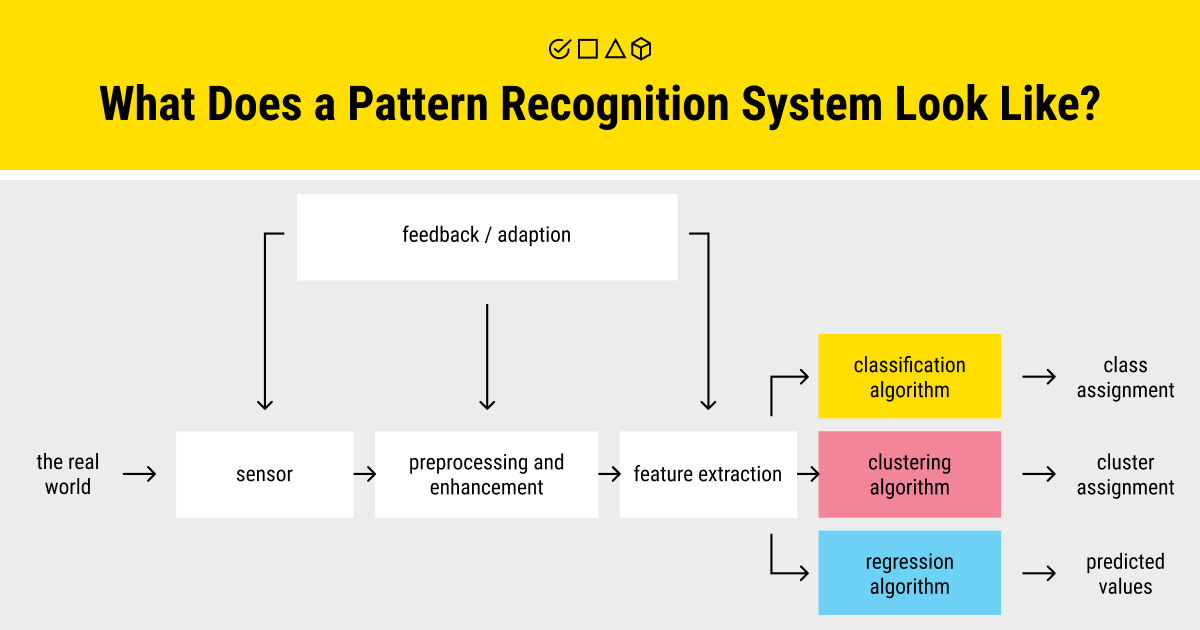

Banking fraud detection relies on four primary artificial intelligence technologies that work together to identify suspicious activities in real-time. Each technology addresses different aspects of fraud detection, from analyzing individual transaction patterns to examining relationships between multiple accounts and communications.

Financial institutions combine these AI technologies to create comprehensive fraud detection systems that can process millions of transactions per second while maintaining accuracy rates above 95 percent. The technologies examine transaction data, customer behavior patterns, communication content, and relationships between different entities to identify potential fraud.

Machine Learning and Pattern Recognition

Source: Label Your Data

Machine learning algorithms analyze transaction data to identify patterns that indicate fraudulent activity. Supervised learning algorithms train on historical transaction data that includes labels identifying which transactions were fraudulent and which were legitimate. The algorithms learn to recognize characteristics that distinguish fraud from normal customer behavior, such as unusual spending amounts, unexpected merchant categories, or transactions at unusual times.

Unsupervised learning algorithms detect previously unknown fraud patterns by identifying transactions that deviate significantly from normal behavior patterns. These algorithms analyze customer spending habits, transaction timing, and purchase locations to establish baseline behavior profiles. When transactions fall outside established patterns, the system flags them for further review.

Graph Neural Networks for Relationship Analysis

Source: NVIDIA Developer

Graph neural networks map connections between accounts, devices, payment cards, and locations to identify coordinated fraud schemes. The technology creates visual networks showing how different entities relate to each other through shared characteristics or transaction patterns. Banks use these networks to detect fraud rings where multiple accounts work together to conduct fraudulent activities.

Network analysis examines patterns such as multiple accounts sharing the same device, similar transaction patterns across different accounts, or funds moving between related accounts in suspicious ways. The system identifies clusters of accounts that exhibit coordinated behavior, which often indicates organized fraud operations rather than individual fraudulent transactions.

Natural Language Processing for Document Fraud

Natural language processing analyzes text in loan applications, customer communications, and identity documents to detect fraudulent information. The technology examines language patterns, identifies inconsistencies between different documents, and detects suspicious phrases commonly used in fraud attempts. Banks apply NLP to verify that customer-provided information matches across multiple documents and communications.

Document analysis includes examining application forms for unrealistic income claims, inconsistent employment information, or copied text from other applications. The system compares writing styles, vocabulary choices, and grammatical patterns to identify applications that may have been completed by the same person using different identities.

How Real-Time Transaction Monitoring Works

Real-time transaction monitoring analyzes financial transactions as they occur, processing each payment within milliseconds to determine fraud risk before completion. Real-time processing examines transactions immediately when customers initiate them, while batch processing analyzes groups of transactions hours or days later during off-peak periods.

When a customer swipes a card or initiates an online payment, AI systems receive transaction data including amount, merchant, location, and device information. The AI engine compares this information against the customer’s historical patterns, fraud databases, and risk models simultaneously. The system generates a fraud probability score and decides whether to approve, decline, or flag the transaction for manual review — all within the time it takes for the payment network to process the authorization.

Traditional batch processing systems analyze yesterday’s transactions today, which means fraudulent payments complete before detection occurs. Real-time systems catch suspicious activity before money changes hands, preventing losses rather than discovering them after the fact.

Millisecond Processing Capabilities

Payment networks require fraud detection systems to make decisions within 10-50 milliseconds to avoid delaying customer transactions. AI systems achieve these speeds by using specialized computing hardware and streamlined algorithms designed for rapid analysis.

The typical transaction authorization process allows 100 milliseconds total, including network transmission time. Fraud detection systems consume only 10-20 milliseconds of this window, leaving sufficient time for payment processing without creating noticeable delays for customers.

Modern AI fraud systems process millions of transactions per second using distributed computing architectures that spread the analytical workload across multiple processors. Graphics processing units accelerate machine learning calculations, while in-memory databases eliminate delays from disk storage access.

Risk Scoring and Automated Decision Making

Source: Nature

AI systems assign numerical risk scores to each transaction, typically ranging from 0-1000, where higher numbers indicate greater fraud probability. These scores combine multiple risk factors including transaction amount, merchant type, geographic location, time of day, and deviation from normal customer behavior patterns.

Decision thresholds determine automated responses based on risk scores. Transactions scoring below 200 typically receive automatic approval, while scores above 800 trigger immediate blocking. Transactions scoring 200-800 enter manual review queues where human analysts investigate further.

Some systems employ step-up authentication instead of blocking, requesting additional verification such as SMS codes or biometric confirmation before processing high-risk transactions. This approach reduces both fraud losses and customer friction from declined legitimate purchases.

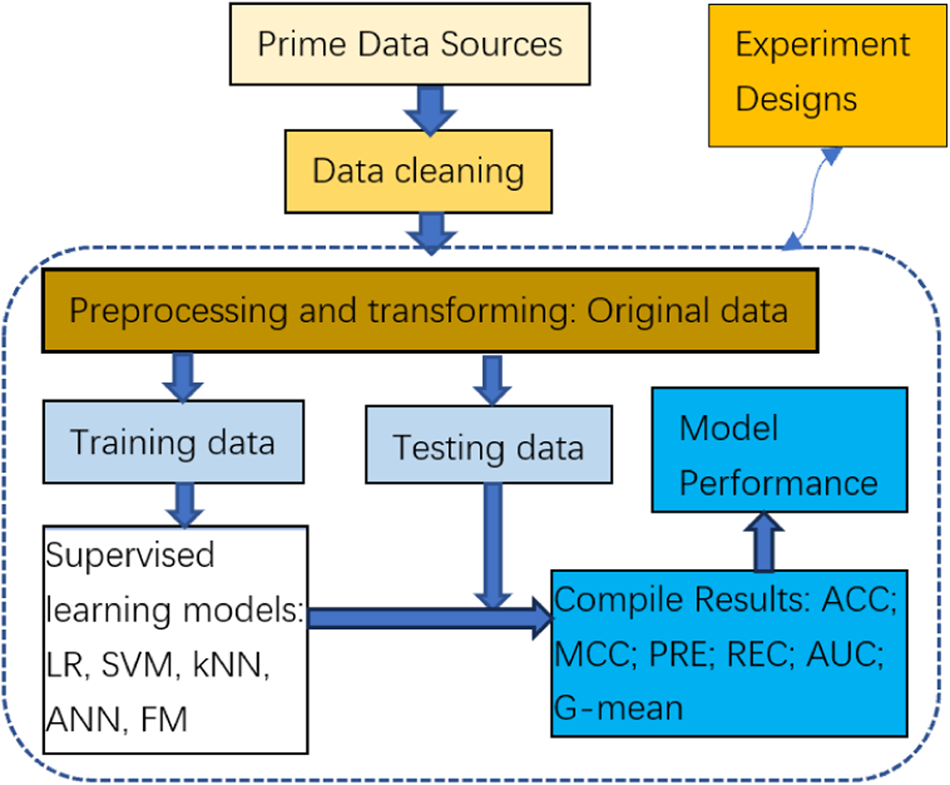

Machine Learning Algorithms for Banking Fraud Prevention

Banks rely on three main categories of machine learning algorithms to detect and prevent fraud: supervised learning models, unsupervised anomaly detection, and deep learning applications. Each algorithm type serves a specific purpose in identifying fraudulent transactions while minimizing false alerts that could disrupt legitimate customer activities.

Supervised learning models work with historical data that includes examples of both fraudulent and legitimate transactions. Financial institutions use this labeled data to train algorithms that recognize patterns distinguishing legitimate customer behavior from fraudulent activity. These models excel at identifying fraud types that banks have encountered before.

Unsupervised anomaly detection algorithms operate without pre-labeled data. Instead, they analyze transaction patterns to identify unusual behaviors that deviate significantly from normal customer activity. Banks use these algorithms to catch new fraud schemes that haven’t appeared in historical data.

Supervised Learning Models

Decision trees represent one of the most interpretable machine learning algorithms banks use for fraud detection. A decision tree works like a flowchart, asking yes-or-no questions about transaction characteristics to determine fraud probability. For example, a decision tree might first ask whether a transaction amount exceeds $5,000, then whether it occurs outside normal business hours, then whether the merchant category matches the customer’s typical spending patterns.

Random forests combine multiple decision trees to create more accurate fraud predictions. Banks train dozens or hundreds of individual decision trees on different subsets of historical transaction data. When analyzing a new transaction, the random forest algorithm consults all trees and uses majority voting to determine the final fraud assessment.

Training data requirements for supervised learning models are substantial. Banks need historical transaction records spanning multiple years, with accurate labels indicating which transactions were fraudulent. The quality of fraud labels directly impacts model performance since algorithms learn to recognize patterns from these examples.

Unsupervised Anomaly Detection

Clustering algorithms form the foundation of unsupervised anomaly detection in banking fraud prevention. These algorithms group similar transactions together based on characteristics like amount, timing, merchant type, and customer behavior patterns. Transactions that don’t fit well into any cluster are flagged as potential anomalies requiring further investigation.

K-means clustering divides transactions into a predetermined number of groups based on similarity. Banks configure k-means algorithms to create clusters representing normal customer behaviors, such as grocery shopping, gas station purchases, or online retail transactions. The algorithm calculates distances between each new transaction and existing cluster centers, flagging transactions that fall too far from any normal behavior group.

Unsupervised algorithms excel at identifying previously unknown fraud types because they don’t rely on historical fraud examples. When criminals develop new fraud techniques, supervised learning models may miss them because they lack training examples. Unsupervised algorithms can detect these novel approaches by identifying deviations from normal transaction patterns, even when the specific fraud technique is completely new.

Behavioral Analytics and Anomaly Detection in Banking

Source: Usermaven

AI systems in banking create detailed profiles of customer behavior by analyzing patterns in transaction data, device usage, and interaction habits. These profiles capture how customers typically conduct their banking activities, including when they log in, how much they spend, where they shop, and how they interact with digital banking platforms.

The AI continuously learns from customer actions to establish baseline behaviors. For each customer, the system tracks dozens of variables such as transaction amounts, frequency of activities, geographic locations, time patterns, and device characteristics. This creates a comprehensive picture of normal behavior for each individual account holder.

Normal behavior patterns include:

- Typing patterns — Keystroke timing analysis

- Transaction timing — Consistent login hours and activity windows

- Spending habits — Regular amounts and merchant categories

- Geographic patterns — Transactions from familiar locations

- Device usage — Consistent smartphones, computers, or browsers

When the AI detects deviations from established patterns, it calculates risk scores based on how significantly the behavior differs from the customer’s historical norm. The system distinguishes between legitimate changes in behavior and potentially fraudulent activity by considering multiple factors simultaneously.

The AI accounts for gradual changes in customer behavior over time, such as salary increases leading to larger transactions or lifestyle changes affecting spending patterns. This prevents the system from flagging legitimate evolution in customer habits while maintaining sensitivity to sudden, suspicious changes that might indicate account compromise or fraud.

AI-Powered Anti-Money Laundering and Compliance

Source: ResearchGate

Anti-Money Laundering (AML) refers to laws, regulations, and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income. Money laundering typically involves three stages: placement (introducing dirty money into the financial system), layering (moving money through complex transactions to obscure its origin), and integration (making the clean money available to criminals).

Financial institutions face strict AML regulations that require them to monitor customer transactions, report suspicious activities, and maintain detailed records. Traditional AML compliance relied on rule-based systems that flagged transactions exceeding certain thresholds or matching predetermined patterns. These systems generated numerous false positives while missing sophisticated laundering schemes that operated below detection limits.

AI transforms AML compliance by analyzing vast transaction networks, identifying subtle patterns across multiple accounts and timeframes, and understanding behavioral characteristics that distinguish legitimate business activities from money laundering attempts. Machine learning algorithms can detect coordinated activities spanning multiple institutions and extended time periods that human analysts might miss. Organizations implementing these systems benefit from understanding responsible AI principles to ensure ethical compliance monitoring.

Automated KYC Processes

Know Your Customer (KYC) regulations require financial institutions to verify customer identities, assess risk levels, and understand the nature of customer relationships. KYC compliance involves collecting identification documents, verifying customer information against government databases, screening for sanctions and watchlists, and conducting ongoing monitoring of customer activities.

AI-powered KYC systems automate document verification by analyzing identification documents for authenticity markers, extracting data automatically, and cross-referencing information against multiple databases simultaneously. Computer vision algorithms can detect document tampering, while optical character recognition extracts text data for verification. Machine learning models create dynamic risk profiles that update continuously based on customer behavior and external risk factors.

Automated identity verification uses facial recognition technology to match customer photos with identification documents and may include liveness detection to prevent spoofing attempts. AI systems can process customer onboarding applications in minutes rather than days, while maintaining higher accuracy rates than manual processes.

Suspicious Activity Detection

Suspicious Activity Reports (SARs) are regulatory filings that financial institutions must submit when they detect transactions that may indicate money laundering, fraud, or other illegal activities. Banks must file SARs within specific timeframes and include detailed information about the suspicious activity, the parties involved, and the reasons for suspicion.

Money laundering detection involves identifying patterns such as structuring transactions (breaking large transactions into smaller amounts to avoid reporting thresholds), rapid movement of funds between accounts, transactions inconsistent with customer profiles, and circular transfers designed to obscure money trails. Traditional detection systems relied on transaction amount thresholds and simple pattern matching that criminals learned to avoid.

AI enhances suspicious activity detection through behavioral analytics that establish normal patterns for individual customers and identify deviations that may indicate money laundering. Machine learning algorithms analyze transaction timing, amounts, counterparties, and geographic patterns to detect subtle anomalies that rule-based systems miss.

Implementation Requirements for AI Fraud Detection

Source: ResearchGate

Organizations planning AI fraud detection systems face several technical and operational requirements that determine success. The implementation process involves multiple phases, each with specific objectives and deliverables that build toward a fully operational AI-powered fraud prevention system.

The foundation of successful AI fraud detection lies in systematic planning and execution. Organizations evaluate their current capabilities, prepare their data infrastructure, integrate new systems with existing technology, and train staff to work effectively with AI tools. Companies considering implementation should explore AI consulting services to navigate these complex requirements effectively.

Data Quality and Preparation

AI fraud detection systems require clean, well-structured data to function accurately. Historical transaction data serves as the training foundation for machine learning algorithms that learn to distinguish between legitimate and fraudulent activities.

Data preprocessing involves cleaning transaction records, removing duplicates, and standardizing formats across different data sources. Organizations typically need 2-3 years of historical transaction data to capture seasonal patterns and evolving fraud tactics.

Feature engineering transforms raw transaction data into meaningful variables that AI algorithms can analyze. Common features include transaction amounts, merchant categories, geographic patterns, time stamps, and customer behavioral indicators.

Data labeling represents a critical component where organizations identify known fraudulent and legitimate transactions in historical data. Accurate labels directly impact model performance and detection accuracy.

System Integration Considerations

AI fraud detection systems integrate with existing banking infrastructure while maintaining transaction processing speed and system availability. API connections enable real-time data flow between AI models and core banking systems.

Legacy system compatibility presents challenges when older infrastructure lacks modern integration capabilities. Organizations often require middleware solutions or API gateways to bridge communication between AI systems and established banking platforms.

Real-time processing requirements demand integration architectures that can analyze transactions within milliseconds while maintaining system performance. Load balancing and distributed processing help manage peak transaction volumes.

Organizations typically implement AI systems in phases, starting with pilot programs that process limited transaction volumes before scaling to full production environments. Gradual rollouts help identify integration issues while minimizing operational risks. Understanding AI change management principles helps organizations manage these transitions effectively.

Frequently Asked Questions About AI Banking Fraud Detection

How long does it take to implement AI fraud detection in a bank’s existing systems?

Implementation timelines depend on the complexity of existing systems and the scope of integration required. Banks typically see initial AI fraud detection systems deployed within 3-6 months for basic implementations. Full optimization and fine-tuning of the models usually takes an additional 6-12 months as the system learns from transaction patterns and receives feedback from fraud investigations.

The process involves several phases: data preparation and cleaning, model development and training, system integration testing, and gradual rollout across different transaction types. Large financial institutions with complex legacy systems may require longer implementation periods, while smaller banks with modern infrastructure can often deploy AI fraud detection more quickly.

What historical data do banks need to train their AI fraud detection models?

AI fraud detection models require three primary types of data for effective training. Historical transaction data forms the foundation, including transaction amounts, timestamps, merchant information, and geographic locations spanning at least 2-3 years to capture seasonal patterns and evolving fraud tactics.

Fraud labels represent the second critical component — these are confirmed classifications of transactions as fraudulent or legitimate based on investigation outcomes. Customer behavior patterns make up the third requirement, encompassing typical spending habits, preferred merchants, device usage patterns, and account activity histories. The data needs to be clean, consistent, and properly formatted, with accurate fraud labels being particularly important since incorrect labels directly impact model performance.

Can AI fraud detection systems work with existing core banking platforms?

Modern AI fraud detection systems connect to existing core banking platforms through Application Programming Interfaces (APIs) and standard banking communication protocols. Most contemporary core banking systems support these integration methods, allowing AI systems to receive transaction data in real-time and return fraud risk scores within milliseconds.

Integration typically occurs through secure, encrypted connections that maintain compliance with banking security standards and regulatory requirements. The AI system operates as an additional layer that analyzes transactions without requiring modifications to the core banking platform’s existing transaction processing capabilities.

How much more accurate are AI fraud detection systems than traditional rule-based methods?

AI fraud detection systems achieve substantially higher accuracy rates than traditional rule-based methods across two key metrics. Detection rates for actual fraud improve by 25-40 percent in typical implementations, meaning AI systems catch significantly more genuine fraud attempts that rule-based systems miss.

False positive rates decrease by 50-75 percent, resulting in fewer legitimate transactions being incorrectly flagged as fraudulent. Rule-based systems apply fixed criteria that criminals can learn to circumvent, while AI systems adapt to new fraud patterns automatically through machine learning algorithms.

What happens when AI fraud detection incorrectly flags a legitimate customer transaction?

AI fraud detection systems incorporate human oversight mechanisms and structured appeal processes to address incorrect decisions. When legitimate transactions are flagged as fraudulent, customers can contact their bank to dispute the decision through established procedures similar to existing fraud protection processes.

The systems learn from these incorrect decisions through feedback loops that update the machine learning models. Fraud analysts review disputed cases and provide corrected labels that help the AI system recognize similar situations in the future. Continuous learning algorithms automatically adjust detection criteria based on this feedback, reducing the likelihood of similar errors occurring again and improving overall system accuracy over time.